Sustainability initiatives have seen rapid adoption across organizations; however, few have the organizational structure to see capital investment and operational execution meet the value they claim to deliver. This creates an unnecessary competition between the goals of the organization and embracing the needs for sustainable business practices in a circular economy.

Key Article Highlights:

- Sustainability and ESG (environmental, social, and governance) planning can drive value creation across the organization faster by moving five critical drivers of cash flow: top-line growth, decreased costs, increases in productivity, optimization of investment, and minimization of legal and regulatory burdens.

- Organizations and leaders can laser focus on four key areas to dramatically capture the momentum of a well-structured sustainability plan for better success.

- Organizations that lack a well-defined structure for the implementation of sustainability programs will see a significant increase in overall risk of failure across several key areas.

Today, more companies, leaders, and investors recognize the strategic importance of ESG. Moreover, the extensive evidence that sustainable corporate business practices are tied closely to company performance drives executives and investors’ key focus across all sectors. As a result, ESG and, more importantly, sustainability has become a crucial part of decision-making in mergers, acquisitions, and even divestitures. Nevertheless, many today still ask how ESG is inextricably linked to performance and how they can act on incorporating good corporate practices into their organization to take advantage of these benefits.

Increasingly companies view sustainability as a strategic and operational value driver rather than compliance. As senior leaders and executives begin to integrate sustainability into corporate strategy, they see the added benefit of having a dedicated effort in the organization to support their vision. There is no proper sustainability structure that applies to every organization; however, each will need a structure of its own and will most likely need to adjust it as operating conditions and requirements demand change. We find that sustainability organizations with a strong focus on organizational design can give the company new capabilities to build value creation and mitigate risks in a systematic and even transformational way.

Investment in global sustainability tops $30 trillion—up 68 percent since 2014 and tenfold since 2004.1 This increase makes sustainability a crucial issue for CEOs in the modern economy. Additionally, there is a marked consumer focus on the extensive impact of corporations and the investors and executives realize that a strong ESG proposition can be a defensive position for a company’s long-term growth. Understanding the link between the extent of capital investment and resource allocation suggests that ESG is more than a fad, feel-good exercise, or a cultural trinket.

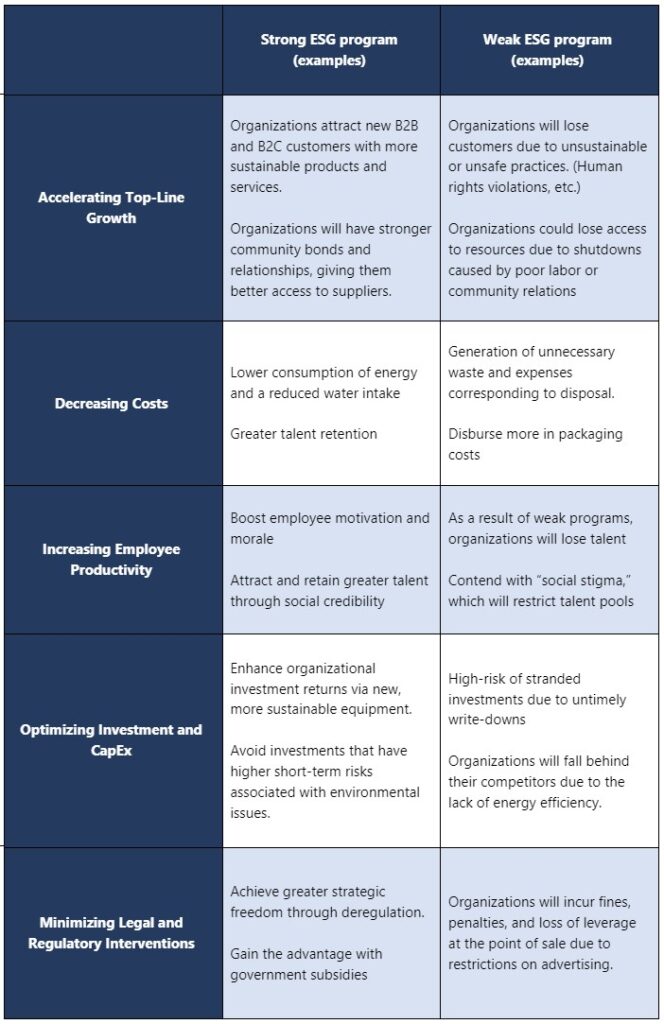

ESG plays a crucial role in reducing downside risk while being linked to increases in value creation, not a reduction. Having a solid ESG position correlates to higher returns on equity in the form of tilt and momentum. 2 Over 2,000 studies of the impact of ESG on equity returns showed 63 percent positive findings versus the 8 percent which found negative findings. 3 Even as the case for solid ESG becomes more persuasive, a case for why these conditions link to value creation is less clear. So how exactly does a strong ESG plan make financial sense? Outlined are five ways that ESG is linked to a positive cash flow.

ESG links to cash flow in five critical ways

- Accelerating Top-Line Growth

- Decreasing Costs

- Increasing employee productivity

- Optimizing Investment and Capital Expenditures

- Minimizing Legal and Regulatory Interventions

These five drivers should be part of an executive’s mental checklist while approaching ESG opportunities. Additionally, having a better understanding of the “softer,” more personal subtleties is needed for the drivers to accomplish their heaviest lifting.

Having a solid ESG plan can accelerate value creation in the following five ways:

Transforming value creation into action: How organizations can initiate action to capture momentum and build value in a short amount of time.

In order to build the right sustainability programs, organizations need to make big decisions. Successful organizations will choose which initiatives under the broad umbrella of sustainability should be the responsibility of their organization as a whole and which issues should be left to other parts of their organization. These initiatives can advance extensively, from building new low-carbon industries and commercializing green products to proactively managing ESG reporting and environmental compliance.

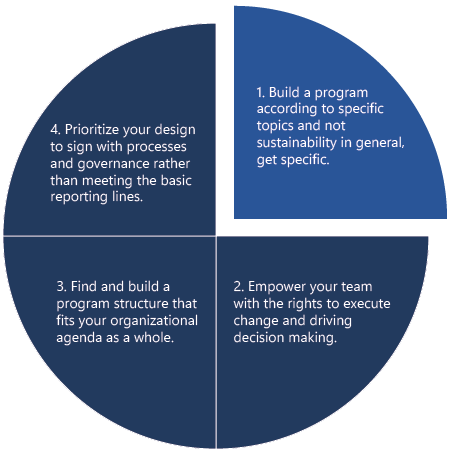

How can executives build organizations focused on sustainability that are well-positioned and are empowered to help their organizations meet increasing expectations from stakeholders’, govern risks associated with sustainability, and seize enterprise opportunities? This article outlines four ways executives can guide the organizational redesign of their sustainability efforts and why they must think differently about sustainability than any traditional business matters.

There are four key areas in that organizations, and leaders can align their sustainability efforts to see success.

1. Build a program according to specific topics, and not sustainability in general. Get specific.

Often the word sustainability is used as a universal term covering many topics. However, for an organization to achieve peak success, they will need to design their sustainability organizations to focus on individual sustainability topics based on priority (an example, green hydrogen or its subtopic, operational decarbonization). To achieve success in this area, organizations should identify the list of sustainability topics that are relevant for the organization, either concerning the business or because these topics are the areas in which the organization is uniquely positioned to make a significant distinction.

The fastest way to achieve success is to complete materiality assessments, which account for the potential impact from, and the likelihood of, a range of issues that could affect the organization. Based on the materiality assessment, an organization can then create a compact list of priority topics for its sustainability team and then make targeted selections of topics that align with the organization. Targeted selections will help organizations make better decisions on resourcing, capital allocations, and organizing around the issues that matter to them.

Supporting sustainability work requires granularity. A modular organizational design—rather than one all-encompassing, centralized sustainability team—often works best. Creating a modular design, allows organizations to remain nimble while rapidly addressing emerging topics in a more systematic and agile way. Sustainability topics may arise rapidly: for example, 2018 saw the number of earnings calls mentioning “plastic waste” increase 340 percent year over year.4 Organizations should look to build sustainability into each business unit rather than a dedicated center of excellence. This allows unique and focused expertise on the topic or will allow them to be principally accountable for leading the organization’s response to it. This approach will allow for greater flexibility and mobility around ever-changing demands.

2. Empower your team with the rights to execute change and drive decision-making.

Even with modularity, it is still essential for organizations to have a central team to focus on particular topics and coordinate the priorities. Additionally, organizations do not require multiple central teams to implement their sustainability agendas effectively. Smaller central teams and more dedicated resources in the business lines that achieve detailed planning and implementation can be more effective. Organizations looking to be highly effective in developing their sustainability programs should have lean central sustainability teams whose mandate is to develop new ideas and integrate sustainability initiatives across the organization.

As with all significant management structures and teams, it is critical that the sustainability team responsible for delivering on the organization’s benchmarks be empowered to take action and be delegated with decision-making authority to execute new change. This authority relates particularly to priorities on sustainability topics that affect multiple functions or have a material impact on the overall organization—understanding that this authority has several dimensions. First, the core group should be centralized with the responsibility for engaging the board of directors on critical sustainability projects since the board holds the ultimate decision rights on such issues and the organization’s strategic direction. The core team should also be empowered to manage the accountability of those working with the group. This accountability management can be accomplished by setting centralized targets and benchmarks. Individuals or business units can now produce specific timelines, initiatives, and plans for pursuing those benchmarks. The core team is responsible for tracking their progress while also maintaining a corporate-wide view of the organization’s performance on the project or topic.

The core team should enlist the organization’s leadership to define the corporate-level strategy and develop the agenda to capture board engagement in and commit to the shared sustainability goals. Then, when the core team has built the strategy and mandated agenda for the business, it can better understand how the agenda cascades through the organization, and those business units have clear guidance on which sustainability priorities to take on.

If an organization requires the core team to make all necessary decisions, the team will be overstretched (especially in smaller groups). This will critically divert attention from specific high-value priorities. Instead, having cross-functional decisions and those highly material to the whole company are best suited for the core team. The authority to make further decisions, such as those affecting separate functions, should be assigned to the sub-team or leaders who are more closely associated with those units.

3. Find and build a program structure that fits your organizational agenda as a whole.

The reporting structure is the first topic organizations consider when looking at structural redesigns. Often the first question is, “Which structure is ideal for the organization, factoring in how we capture the full potential of sustainability?” The reality is that there is no “right” answer in designing a sustainability team and no one-size-fits-all method beyond the common notion that the structure should be deeply integrated into—and compatible with—the rest of the organization’s setup. That said, McKinsey & Company has outlined several organizational models that tend to be more effective at elevating the proper strategic priority around sustainability.

Source: McKinsey & Co.

Modern organizations looking at the strategic value of sustainability will typically embed the team in a support role or as a fully decentralized team within a business unit. The three models outlined above by McKinsey give a glimpse of how the organization can structure the team to provide a solid foundation for success and provide the sustainability team with the most decisive decision-making authority.

A large central team will plan and maintain the decision rights to most sustainability initiatives and coordinate with individual business units that are actively working on specific sustainability issues or have expertise related to the topic. The central team incubates sustainability initiatives before distributing them off to the business units and strengthens movements that have no other natural owners in the organization. The team also confirms that sustainability priorities throughout the organization have adequate budgets and staff and that the organization stays focused on its focus topics. A central team may also have the best view of broader sustainability trends and stakeholder demands, though it is less equipped than business units to respond to new sustainability-related market opportunities and risks.

Additionally, the value of a lean central team is determined by their decision rights and many business-unit factors. In this team structure, setting the prioritization of topics is primarily a top-down process led by the LCT. This helps to ensure that a common organization-wide agenda and objectives are in place. Business units’ specific initiatives have a mandate to develop & achieve organization-wide goals, which they do by deploying their assets. Business units also have the resources and flexibility to set up and work on initiatives of their own, in line with the team’s guidance. In our experience, this structure can be most effective in companies that have already embedded sustainability in the organizational culture, which increases the likelihood that sustainability becomes a genuine cross-functional effort.

Finally, there is the option of deploying an agile central team to business units. This team structure allows a single central team to lead the deployment of sustainability-focused task services to individual business units. Once a “task force” is embedded in a business unit, it will serve to plan and initiate the execution of that specific business unit’s priority initiatives while building capabilities so that the business can eventually run its initiatives. Once this is complete, they will move to the next business unit. This approach facilitates the rapid deployment of sustainability expertise and the mutual sharing of best practices across the organization and provides the nimble reallocation of resources in reaction to the precipitously shifting sustainability environment. From a talent-development standpoint, this execution model (sometimes referred to as a “helix organization”) also allows for a more precise division of leaders—between those who help individuals acquire capabilities and those who administer employees’ day-to-day efforts. The consequence is that sustainability talent can be developed both ways.

4. Prioritize your design to align with processes and governance rather than meeting the basic reporting structure.

An organizational redesign can be three times more likely to succeed if the focus is not on the reporting structure. Going beyond the “lines and boxes” allows a focus on multiple elements (business processes, culture, and performance management) and not simply changing the reporting structure as it relates to sustainability topics, which requires the reorganization of functions that are multifaceted and far more complex concerning priorities which can shift rapidly. Therefore, it is critical to consider processes and governance in the early stages when redesigning sustainability-related teams. Establishing several guiding principles can help with this kind of effort.

One-way organizations can tackle this is by making decisions related to sustainability, both clearly defined and robust. Doing so will allow decisions and issues to be escalated from the specific business unit or team to the central sustainability team. This framework is key to effectively managing the reporting structure while supporting empowerment at the individual business unit or team level. This process involves frequent discussions with stakeholders and rapid decision-cycles to identify high-level or cross-functional topics which can be swiftly resolved.

As with most cases, the core team needs to be empowered to take action and make decisions on the topics which individual business units cannot resolve. If the core team cannot resolve a high-priority issue successfully, it can then escalate these to the leadership team or the board. Many organizations do not adapt their pace on engaging with sustainability issues as they would with other issues. These issues require a more rapid approach to decision-making and responses than other business issues. For many organizations in traditional and mature sectors (for example, steel, cement, petrochemicals, and other heavy industries) accustomed to longer decision-making cycles, this should require a significant shift in mindset. The executive team is responsible for affecting this shift by expounding that sustainability is an imperative organizational priority that requires various decision-making methodologies.

Capital allocation and the processes and governance surrounding an effective sustainability program are other principles that should be addressed. Due to the expansive uncertainty compared to traditional investments, investments in sustainability are evaluated on a different risk-return profile. As a result, many organizations that lead sustainability initiatives have allocated a separate group of funds dedicated to sustainability topics. Additionally, they have defined different benchmark rates for sustainability investments, have created internal costing around carbon to account for its impact and related risks to those investments, and put a defined structure to facilitate capital allocation and M&A activities.

Finally, sustainability-specific performance metrics are vital for companies to track and ensure successful adherence to program goals and benchmarks. The principles of good performance management of other business activities also apply to sustainability. Take time to set the specific metrics, some of which will vary depending on the focus, set both financial and nonfinancial measurable targets, establish incentives (compensation linked to sustainability performance), and put in place regular performance reviews of sustainability drive results.

Throughout this article, there is an established path of success for organizations focused on delivering real change to the organization through focused sustainability and ESG programs. Sustainability is not a matter of compliance or convenience for most organizations but a calculated operational and strategic one. As executives and leaders deliver integrated sustainability into their corporate strategy, those leaders will benefit from having a dedicated team to support their sustainability efforts. As stated before, there are many key benefits to getting sustainability and ESG right; however, no one structure applies to every organization; each team needs its structure, which will likely be adjusted as business requirements and conditions change. Nevertheless, a well-designed sustainability team can give the organization the credentials to seize value and mitigate risks from sustainability in a transformational and systematic way.